Small Manufacturers Are Experiencing Large Growth

Although almost $3 billion in losses took place in U.S. retail during the first quarter because of a shift in the timing of Easter as well as changing consumer preferences, growth is not impossible. Contrary to what the numbers show, a few small food and beverage manufacturers are thriving during an unexpected time. Only five years ago, the largest food and bev manufacturers represented one-third of all dollar sales. However, to date, they account for only 31%, and smaller manufacturers (which exceed $100,000 in sales annually) have gained the two percentage points of market share, valuing at about $2 billion. Currently, nearly 16,000 companies, which make up the smallest manufacturers, are responsible for 19% of dollar sales and are also experiencing over half of the growth (53%).

For Full Article and Results From Nielsen, please visit: http://www.nielsen.com/us/en/insights/news/2017

Transparency is Now Key to Consumer Approval

Research put into the shift of growth in the U.S. retail industry shows that transparency is winning. Small manufacturers place a significant portion of their focus on health as well as the need to provide a transparent environment for consumers. At the same time, they do well to maintain an exceptional price point that retailers love!

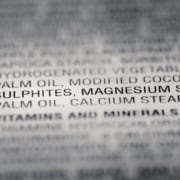

Clean Labels Gaining Popularity

A “clean label” refers to a product that does not contain any artificial sweeteners, preservatives, colors, and flavors, as well as antibiotics and hormones in beverage and food categories. These products also typically make marketing label claims on their packaging to entice consumers.

As shown in a worldwide ingredients survey conducted by Nielsen, consumers have a tendency to keep a close eye on the details of products―actually, nearly three-quarters of survey participants said they felt positively toward businesses dedicated to honesty regarding their product sourcing; 68% were willing to spend more money on beverages and food free of ill-favored ingredients; 64% of the diets of consumers forbid specific ingredients. The longing for clean labels stems from the growing desire for company transparency.

Clean label products are now responsible for 30% of sales in the market, which has grown by 5.6% over the last five years. Small manufacturers dominate large competitors regarding clean label sales and growth. This past year has shown that small manufacturers sold the most share of clean label products in comparison to their other sales. Small manufacturers led with 40% of their sales coming from clean labels, followed by middle-sized manufacturers at 38%, private-label manufacturers at 27%, and lastly, large manufacturers at 24% of their sales coming from clean label products.

Small manufacturers take the lead in premium price tiers as well. Recently, premium-priced sales made up 44% of small producers’ sales, a significant difference when compared to the premium price of the sale of large manufacturers, recorded at 39% and below.

During the last five years, both medium- and small-sized manufacturers have upped their distribution throughout regions, resulting in a greater amount of space inside stores. Out of the roughly 900 beverage and food items that have been stock on store shelves since 2013, 88% came from medium- and small-sized companies. Retailers are giving small manufacturers an opportunity to sell their products to customers more frequently than ever before.

Increasing Sales with Promotion

Due to a larger variety and connection to real consumer desires, smaller and private manufacturers are finding sales success while also spending less on the promotion of their offerings. Larger corporations, on the other hand, have spent much more money than average on trade promotions. As of April 2017, sales based on advertising are accredited to 40% of large manufacturers’ sales, compared to 27% of small manufacturers’ sales.

As the demand for clean label products increases, more and more people will be willing to buy them, whether or not there are promotions. To adapt to the smaller manufacturers taking advantage of this trend, retailers and marketplaces must provide more space in order to account for the consumer demand. The long term success of this trend is still undefined. We will see how large brands respond. The most consistent way to adapt for large companies is through the acquisition of small manufacturers.

Inspired by www.nielsen.com