DanoneWave Quietly Reduces Fat and Sugar

The French multinational food manufacturing giant, DanonWave, is famous for making nutrient-dense foods with less fat and sugar. The company is known for its brands such as Danimals, Dannon, Activia yogurt, and newly acquired plant-based brands like Vega and Silk. While it is one of the main players in the health food industry, the company has recently announced that it will embark on improving its products by boosting their fiber, protein, Vitamin D, and decreasing the fat & sugar. This announcement was part of the company’s recent commitment to address childhood obesity.

According to Philippe Caradec, Vice President of Corporate Affairs, the company values its mission to bring healthy food to as many people as they can reach all over the world.

Why Are Companies Like DanoneWave Redeveloping Their Portfolio?

Most of the giant food and beverage manufacturers have been redeveloping their portfolio by creating new product formulations or acquiring healthy startups. But, what is the reason behind this? It is imperative for big food companies to meet the changing demands of their consumers.

It is important to take note that more consumers are opting for healthier foods, so changing the brand portfolio is a good strategy to draw in more future customers. Examples of food companies that have revamped their portfolio by releasing a healthy line of products include Coca-Cola, PepsiCo, and Campbell Soup.

But what about DanoneWave? The company embarked on its robust portfolio when it acquired the great beverage-maker WhiteWave in a $10.4 billion deal. The company has been making snack bars, cookies, and more over the past few decades. While it has been treading on the health food path longer than other companies, DanoneWave lacks variety, so the company is betting on products like bottled waters, baby foods, and yogurts.

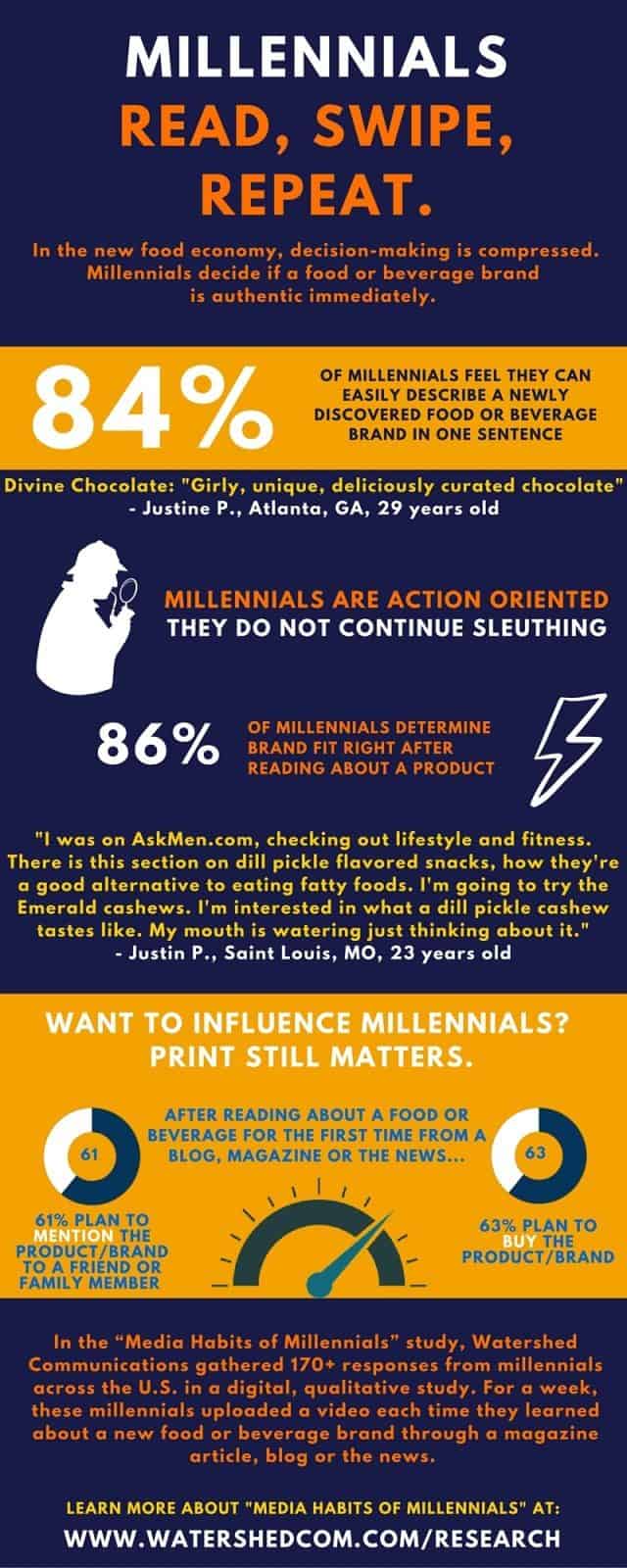

Millennials: The New Market

While some companies embark on revamping their portfolio as part of a bandwagon or fad, DanoneWave sees another potential. In fact, they are revamping their product line because they see the Millennials as the most promising of all target markets.

The biggest driver of the health food niche are millennials who are now becoming more aware of lifestyle diseases and healthy options. But while marketing to the millennials is needed by most health food companies, it is quite challenging to convince millennials to buy products by just claiming that they are sugar-free or fat-free. Marketing products as such can also lead to consumers to think that they are consuming products that are less appealing. Millennial consumers are becoming wiser every day, so companies like DanoneWave have to include clean labeling and transparency in their products by including honest nutritional labels on each of their products.

The future of health food companies like DanoneWave lies in the hands of meticulous consumers. This is the reason why it is so important to use different strategies such as reformulating their products, revamping their brand, acquiring healthy food start-ups, and also using transparent clean labels.

Inspired by fortune.com

Simple ingredients are the key to answering the call for healthy snack alternatives in the market. It’s important to find trusted suppliers of simple and natural ingredients. Look no further than NutriFusion® for natural nutrient fortification of your products. Instead of using typical synthetic nutrient materials, you can use our whole food based products. NutriFusion® is made from organic, non-GMO produce in a variety of blends. We can work with you to develop a custom fruit and vegetable blend to meet your needs. If you are interested in learning more about NutriFusion® for consumer packaged foods, click the button below to learn more.

Simple ingredients are the key to answering the call for healthy snack alternatives in the market. It’s important to find trusted suppliers of simple and natural ingredients. Look no further than NutriFusion® for natural nutrient fortification of your products. Instead of using typical synthetic nutrient materials, you can use our whole food based products. NutriFusion® is made from organic, non-GMO produce in a variety of blends. We can work with you to develop a custom fruit and vegetable blend to meet your needs. If you are interested in learning more about NutriFusion® for consumer packaged foods, click the button below to learn more.